Prevent Financial Risks with AML Checks

2024-02-24 • By By Team fraudcheck.ai

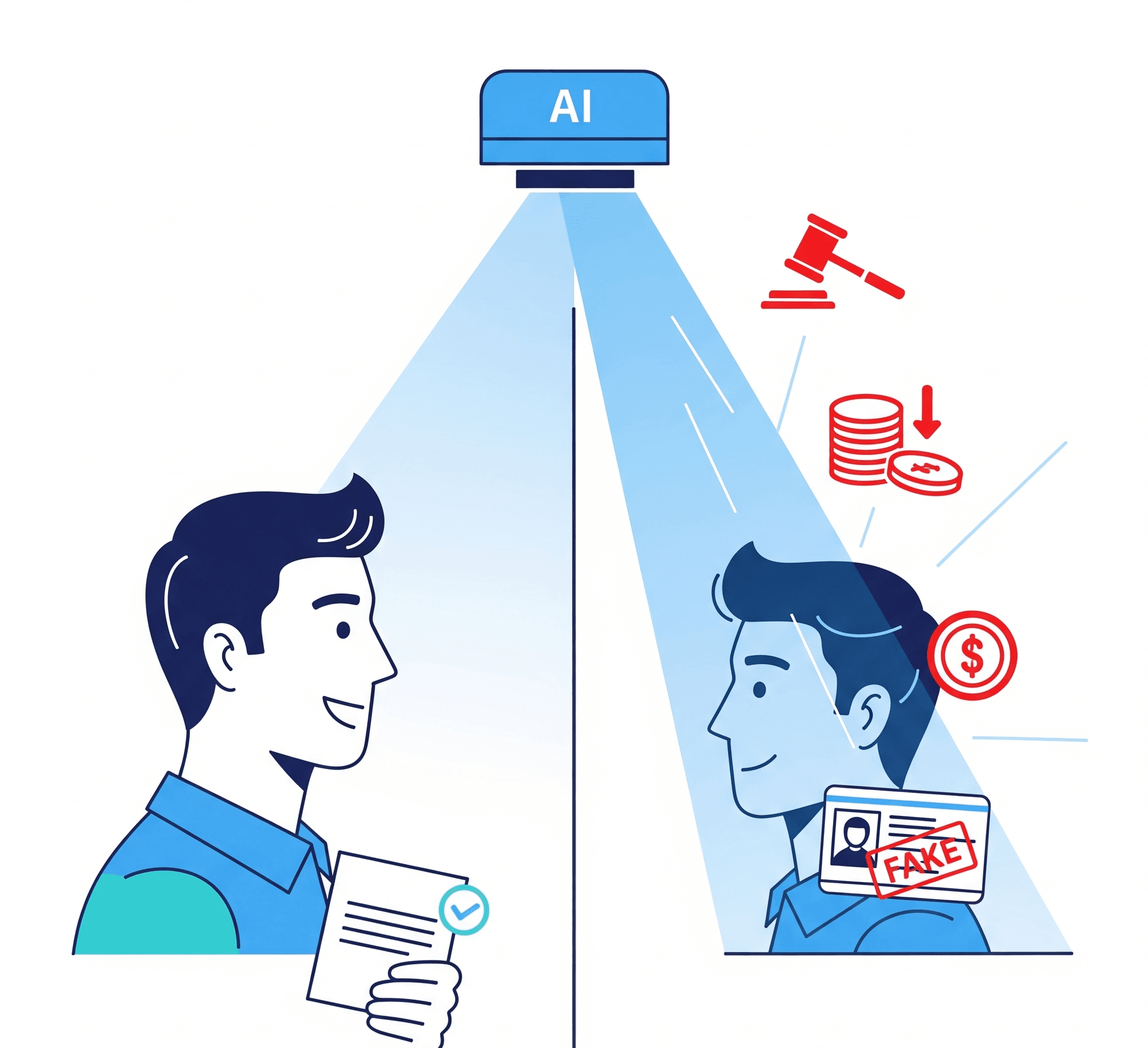

Money laundering and financial frauds are on the rise, and unsuspecting individuals as well as businesses can easily become targets. Criminal networks often disguise illegal money by channeling it through legitimate systems, creating hidden risks for partners, employees, and stakeholders.

Why AML Checks Are Essential

Conducting an AML (Anti-Money Laundering) check protects you from potential financial, legal, and reputational risks. Whether you are entering into a personal financial agreement, onboarding a new business partner, or finalizing a high-value transaction, AML checks act as your first layer of protection.

How AML Verification Works

Our AML process examines financial histories, bank affiliations, transaction footprints, and potential connections to suspicious entities. By screening across global databases, sanctions lists, and politically exposed persons (PEPs), AML verification ensures that hidden risks are identified before commitments are made.

- Detect hidden financial risks early

- Ensure transparency in business and personal relationships

- Protect against regulatory penalties

- Identify links to blacklisted or sanctioned entities

- Strengthen trust and credibility in partnerships

AI-Powered Speed and Accuracy

Traditional compliance methods are slow and often prone to oversight. AI-powered AML screening, however, processes thousands of records in seconds. By leveraging machine learning, it automatically flags inconsistencies, hidden liabilities, or unusual financial patterns that may indicate risk. This reduces human error and provides reliable results in minutes.

AML in Everyday Transactions

AML checks are not limited to large corporations or banks. Individuals can benefit too. Before lending money, entering marriage with shared finances, or investing in property deals, an AML check ensures that the other party does not have undisclosed financial complications or connections to illicit activity.

Global Compliance Made Simple

With financial regulations tightening worldwide, businesses that fail to comply with AML laws risk hefty fines, legal action, and loss of trust. Fraudcheck.ai makes compliance simple by offering automated, global checks that adapt to local and international regulatory frameworks.

“Compliance is no longer optional — AML checks are the backbone of financial safety.”

With fraudcheck.ai, AML and money laundering checks are fast, secure, and privacy-first. Our advanced AI system ensures accuracy by cross-verifying multiple sources, giving you peace of mind before entering any agreement. Protect your money, your reputation, and your future by making AML checks a non-negotiable part of your decision-making.

Related Articles

Property Check: Secure Your Dream Home Before Buying

For many Indians, owning a home or land is a lifelong dream. But with rising cases of property fraud, fake documents, and disputed ownerships, this dream can quickly turn into a nightmare. Property verification is no longer optional — it’s essential to safeguard your hard-earned money.

AI vs. Hidden Red Flags: How Smart Checks Reveal What People Don’t Tell You

Trust is essential in every relationship and decision — whether it’s marriage, renting a home, or buying property. But hidden truths like criminal cases, financial debts, or forged documents can destroy trust overnight. This is where AI steps in: to uncover the red flags people don’t reveal.